Financing equipment can be confusing, especially when you begin evaluating the options for financing terms. But it doesn’t have to be difficult. Here are a few questions you should ask to better manage the financing decision process.

- How long do you expect to own the equipment?

- What is the expected utilization of the equipment – number of miles or service hours?

- How will the machine depreciate in value?

- Will the loan amortization facilitate your goals for asset resale, trade-in or disposition?

Amortization Vs Depreciation

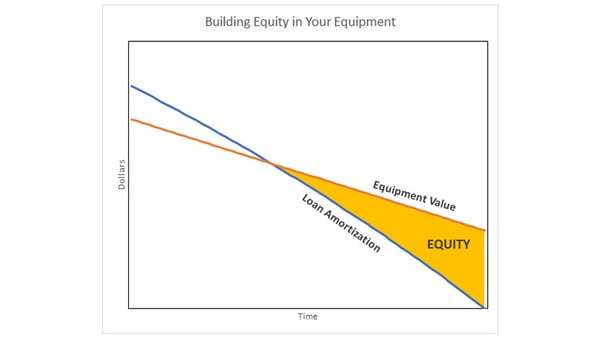

The amortization of the loan is the repayment of the loan principal over time. It is not a straight line. More interest is paid in the early years than later in the equipment loan. Depreciation is the reduction in the value of the equipment financed over time. When you are considering loan terms, especially loan duration, compare the amortization of the loan to the depreciation of the equipment. And answer these questions:

The amortization of the loan is the repayment of the loan principal over time. It is not a straight line. More interest is paid in the early years than later in the equipment loan. Depreciation is the reduction in the value of the equipment financed over time. When you are considering loan terms, especially loan duration, compare the amortization of the loan to the depreciation of the equipment. And answer these questions:

- What will the approximate payoff of the loan be at various times … 24 months? 36 months? 42 months? 48 months?

- What, given the use application (miles driven, hours of service, care and maintenance), will the equipment be worth at those various times?

- How do the values of the equipment at the given time frames compare? Are you in a positive or negative equity position at those intervals?

Payments and Cash Flow

When many people consider an equipment loan, they focus on their monthly payments, and their short-term cash flow needs. The longer the loan term, the lower the payments. Consider a shorter term for your loan. Although this will result in marginally higher monthly payments you will save a substantial amount in interest expense over the course of the loan which is often more impactful than a marginally lower interest rate. All while building equity in your equipment much quicker.

- What payment level can your business cash flow handle?

- Do you want to save borrowing costs over the term of the loan?

- What balance between current cash flow and cost savings, coupled with accelerated equity is best for your business?

Contingency Plans

Equipment equity can be used for more than trade-in or resale value. You can use equity in your equipment to obtain working capital loans to fund business operations, purchase new equipment, or borrow money to meet unforeseen circumstances. If you have no equity in your existing equipment, your financing options could be limited.

- Do you want to expand your business, or purchase a competitor’s business?

- Would you ever want to replace equipment early?

- Could you lose operating contracts, or have an accident or insurance loss?

Market Value Vs Book Value

Banks will typically look at your financial statements to determine the value of your equipment. But you know there is a difference between market value and an accounting book value of equipment. Book value refers to the equipment value less tax depreciation; market value is the amount your equipment is actually worth. You need a funding partner who will look past the book value of your equipment and look at the real equity you have accumulated. You should always consult your tax accountant when you consider how you will account for the taxable equipment value. Their advice can assist you with these questions:

- How much real equity do you have in your equipment?

- How can you use that equity to help meet your financial goals?

The answers to all the above questions can you help you evaluate the needs and goals of your business. And it’s important to align any financial decisions with those needs and goals. CCG can help guide you through the questions and structure an equipment loan that best meets the needs of your business. That's what makes us different.