By refinancing your existing equipment loans and/or equipment that's already been paid for, we can help you reduce your monthly cash outlay, free up working capital, and/or provide capital to fund business operations and expansion. We can also help you pay off other loans and obligations, including MCAs and tax liabilities.

Ready to get started? Submit the form and one of our team members will be in touch with you soon.

In the first example, the company didn't need working capital, but wanted to significantly decrease their monthly payments. They refinanced their existing equipment loan and were able to lower their monthly loan payment by 69%, saving $19,400/month (which is approximately $232,800 per year)!

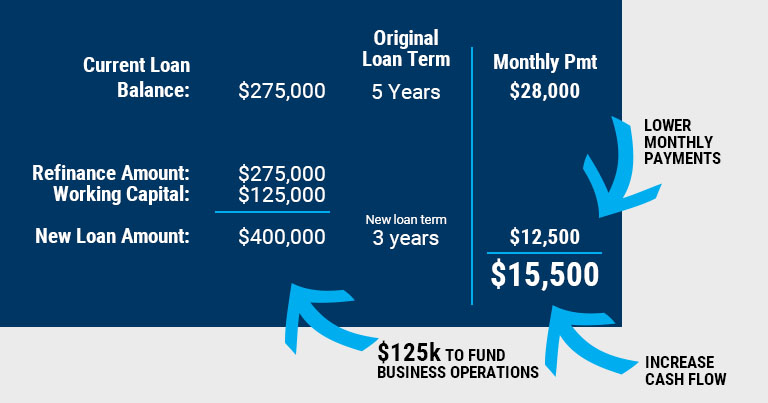

In the second example, the company refinanced 10 trucks and received $125,000 of working capital to fund business operations. Even with additional working capital, they were able to lower their monthly loan payment by nearly 45%, saving $15,500/month (that's $186,000 per year)!